Before your vehicle can gets the necessary repairs it needs done following the occurrence of a wreck, a number of things must occur. For starters, the insurer assigned to pay the claim will want to determine whether your vehicle can even be repaired or if it is a total loss. A car that would be considered totaled is one that is worth less than what the repairs are estimated to be.

For example, if an insurance adjuster estimated your repairs to be about $8,000 but your vehicle is only worth $5,000, the company may not want to want to pay to get it fixed as it would cost more than the vehicle’s actual cash value. Instead, the company would likely choose to pay you the book value of your car so that you can get apply the amount toward a new vehicle [Source: Insurance Information Institute (III)].

Some Other Important Things You Need to Know About the Claims Process

While most assume that the claims process is as simple as submitting a claim and receiving a check to cover their property damage, it is often much more complex than that. Claims are often denied or payment is delayed resulting in the victim struggling to recover the funds they know they are entitled to receive. Unfortunately, the claims process is often much more different and difficult than what a car crash victim expects which is why anyone who has been involved in a car crash in Nashville, TN is encouraged to hire a car wreck attorney to help them collect the money they are eligible to receive.

What else should I know about the claims process?

- The estimate you receive for the damage that has been done is just that, an estimate. When an adjuster assesses your damage, he or she is going to provide you with an amount they believe would be enough to cover your damage. Unfortunately, this estimate will likely be lower than what your damage may actually be worth which is why we encourage you to consider the following tip provided below.

Tip: Rather than accept the initial estimate you receive, take some time to gather some estimates of your own from reputable mechanics. Ask friends, family, or coworkers to recommend some auto mechanic shops that would be able to provide you with an estimate so you can better determine if the amount the insurer has offered is accurate and fair. If you find that the estimates you receive from the mechanics you chose to bring your vehicle to is higher than what the adjuster suggested, provide these estimates to him or her so they can reassess the one they initially provided you with.

- You hold the right to negotiate with the adjuster. That’s right. Although the insurance adjuster is going to place a value on your claim and lead you to believe that is the final amount the company will pay, this is not entirely true. In fact, you have the right to negotiate with him or her. How do you negotiate with an insurance adjuster?

Well, if you firmly believe the amount the adjuster offered is too low and you have documentation that proves your damage is valued much higher than the adjuster’s estimate, you can request that they increase their offer. In some instances, they may go up a little depending on how much supporting evidence you provide. In the event they do but you still feel as though the amount offered is too low, don’t allow the negotiation process to end.

Tip: Insurance adjusters have been trained to negotiate in a way so that they pay the lowest amount possible for a claim. They know what to say and how to say it so that a claimant feels obligated to accept the amount they offer. Rather than attempt to go into the negotiation process unprepared, you can always hire Nashville car wreck lawyer George R. Fusner Jr. who can help you recover the maximum amount of compensation you are entitled to, not an amount that will barely cover your vehicle’s damage.

- Your insurer cannot require you to take your vehicle to a particular repair shop. Insurance companies often work with specific repair shops that may be able to do the work for them at a low cost. However, you aren’t obligated to have your vehicle repaired at a shop that your insurer prefers.

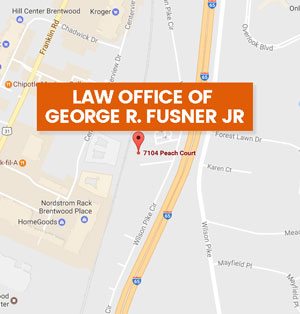

To ensure your car wreck claim is processed in a timely manner and that the insurer handling it is fair, we do encourage you to contact the Law Office of George R. Fusner Jr. to schedule a consultation to learn more about your rights as a car accident claimant.

You can reach the Law Office of George R. Fusner Jr. at

7104 Peach Court

Brentwood, TN 37027

Phone- 615-251-0005

Fax- 615-370-8447

Website: www.gfusnerlaw.com